GateUser-7033158a

No content yet

GateUser-7033158a

How is the Notpixel project and the PX token doing🤔?

The second Notpixel tournament has been running for 40 days now🥲, and it will only end when there are fewer than 512 pixel purchases in a one-hour window☝️.

TOKEN8.32%

- Reward

- like

- Comment

- Share

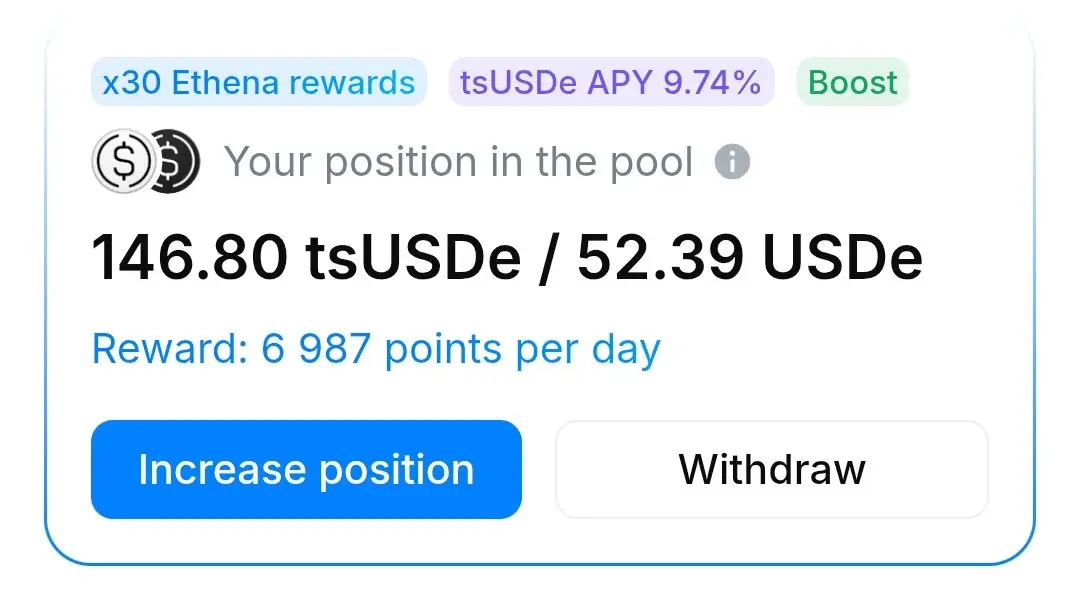

Top 3 best pools on the DEX right now based on risk-reward ratio📈:

🥇 tsUSDe/USDe – No Risk

By holding liquidity in this pool, you’re participating in the airdrops from Ethena and TON. You also earn pool fees (0.2%) and 12% APY from tsUSDe.

More info on

🥈 TON/USDT – Low Risk

Providing liquidity here gives you 12% APR from swap fees + 2.5% from farming.

🥉 PX/USDT – Medium Risk

This one’s more of a bonus pick — mainly for those who believe in the PX token. It used to generate a steady 70% APR, but currently you can expect around 30% APR.

Personally🤔, I’m waiting for everyone to dump their

🥇 tsUSDe/USDe – No Risk

By holding liquidity in this pool, you’re participating in the airdrops from Ethena and TON. You also earn pool fees (0.2%) and 12% APY from tsUSDe.

More info on

🥈 TON/USDT – Low Risk

Providing liquidity here gives you 12% APR from swap fees + 2.5% from farming.

🥉 PX/USDT – Medium Risk

This one’s more of a bonus pick — mainly for those who believe in the PX token. It used to generate a steady 70% APR, but currently you can expect around 30% APR.

Personally🤔, I’m waiting for everyone to dump their

- Reward

- 1

- 1

- Share

GateUser-8982d60a :

:

Bitcoin Ta Da MoonTop 3 best pools on the DEX STONfi right now based on risk-reward ratio📈:

No Risk pool - By holding liquidity in this pool, you are participating in the airdrops from Ethena and TON.

- Reward

- like

- Comment

- Share

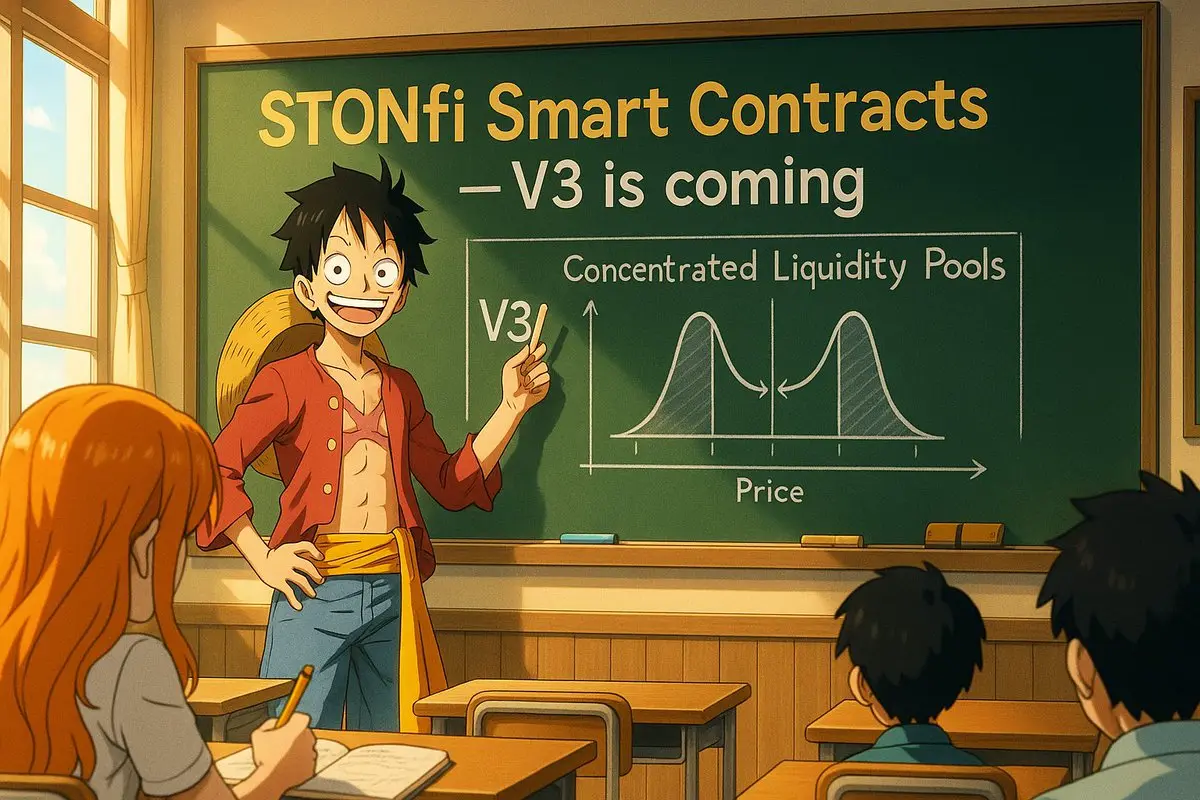

is developing V3 smart contracts, which will enable concentrated liquidity pools📌.

I’ve noticed that many people on TON still don’t fully understand what that means or how it works — so here’s your quick guide😜👇:

The main difference between a regular liquidity pool and a concentrated liquidity pool is that when providing liquidity, you choose a price range where your liquidity will be active📊.

Once the price moves out of that range, your liquidity stops participating in swaps and stops earning you fees☝️.

You might wonder — what’s the point then🤔?

Well, the point is: the narrower the pric

I’ve noticed that many people on TON still don’t fully understand what that means or how it works — so here’s your quick guide😜👇:

The main difference between a regular liquidity pool and a concentrated liquidity pool is that when providing liquidity, you choose a price range where your liquidity will be active📊.

Once the price moves out of that range, your liquidity stops participating in swaps and stops earning you fees☝️.

You might wonder — what’s the point then🤔?

Well, the point is: the narrower the pric

- Reward

- like

- Comment

- Share

STONfi is developing V3 smart contracts, which will enable concentrated liquidity pools📌.

I’ve noticed that many people on TON still don’t fully understand what that means or how it works — so here’s your quick guide😜👇:

The main difference between a regular liquidity pool and a concentrated liquidity pool is that when providing liquidity, you choose a price range where your liquidity will be active📊.

Once the price moves out of that range, your liquidity stops participating in swaps and stops earning you fees☝️.

You might wonder — what’s the point then🤔?Well, the point is: the narrower th

I’ve noticed that many people on TON still don’t fully understand what that means or how it works — so here’s your quick guide😜👇:

The main difference between a regular liquidity pool and a concentrated liquidity pool is that when providing liquidity, you choose a price range where your liquidity will be active📊.

Once the price moves out of that range, your liquidity stops participating in swaps and stops earning you fees☝️.

You might wonder — what’s the point then🤔?Well, the point is: the narrower th

- Reward

- like

- Comment

- Share

How not to lose money in farming pools on — sharing from personal experience🧐!

I bought tokens and added them to the $Blum/ $TON farming pool when the APR was around 500%🚀. I made this decision because I thought the $Blum token wouldn’t drop below $9M (I bought it at $10M), and even if the APR dropped by half, I could still end up with a good profit💸.

But the $Blum token fell to $6.3M📉, which made the strategy unprofitable. Even with the growth of the TON token, I’m down about -7%. Sure, Blum might still go up, especially with a burn🔥 event coming in August — but that’s not the point.

My

I bought tokens and added them to the $Blum/ $TON farming pool when the APR was around 500%🚀. I made this decision because I thought the $Blum token wouldn’t drop below $9M (I bought it at $10M), and even if the APR dropped by half, I could still end up with a good profit💸.

But the $Blum token fell to $6.3M📉, which made the strategy unprofitable. Even with the growth of the TON token, I’m down about -7%. Sure, Blum might still go up, especially with a burn🔥 event coming in August — but that’s not the point.

My

- Reward

- like

- 1

- Share

ZGZjDjj :

:

Is there a simple way to transfer BLUM purchased on other platforms to TON? The accelerator is very unstable and inconvenient. Is there a web version of your own?How not to lose money in farming pools on STONfi — sharing from personal experience🧐!

I bought tokens and added them to the Blum/TON farming pool when the APR was around 500%🚀. I made this decision because I thought the Blum token wouldn’t drop below $9M (I bought it at $10M), and even if the APR dropped by half, I could still end up with a good profit💸.

But the Blum token fell to $6.3M📉, which made the strategy unprofitable. Even with the growth of the TON token, I’m down about -7%. Sure, Blum might still go up, especially with a burn🔥 event coming in August — but that’s not the point.

M

I bought tokens and added them to the Blum/TON farming pool when the APR was around 500%🚀. I made this decision because I thought the Blum token wouldn’t drop below $9M (I bought it at $10M), and even if the APR dropped by half, I could still end up with a good profit💸.

But the Blum token fell to $6.3M📉, which made the strategy unprofitable. Even with the growth of the TON token, I’m down about -7%. Sure, Blum might still go up, especially with a burn🔥 event coming in August — but that’s not the point.

M

- Reward

- 1

- 1

- Share

SmallTownBigGodOfWealth :

:

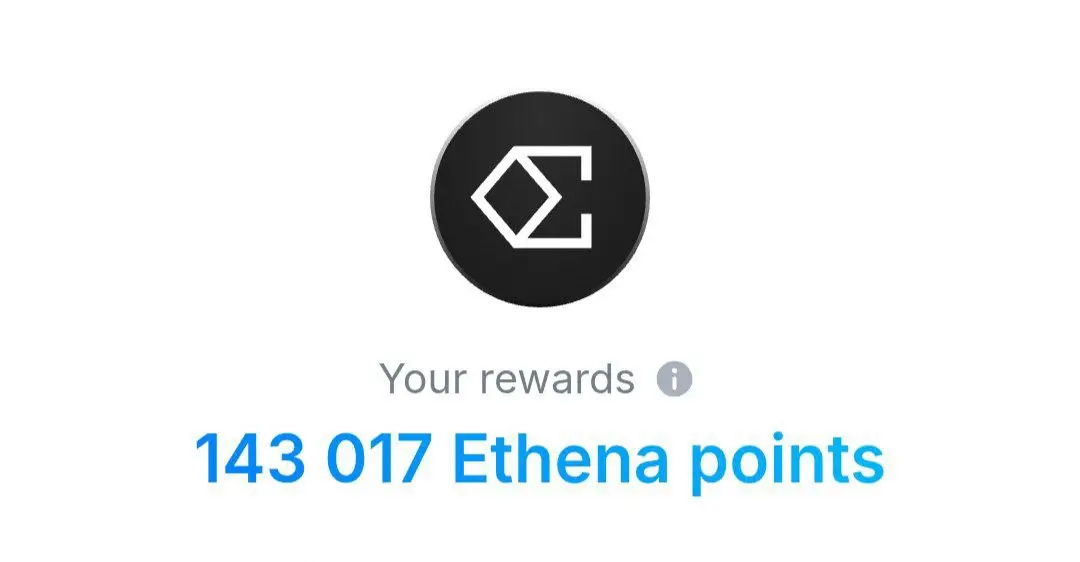

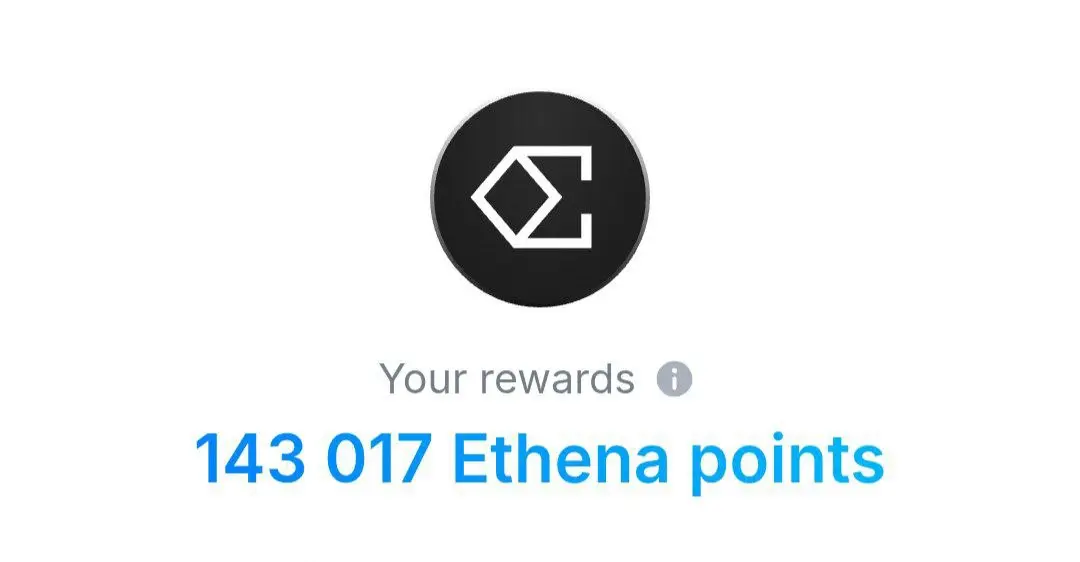

。。。。。。。。。。。。。。。。。。In almost a month of farming the Ethena airdrop, I’ve farmed 143k Ethena points🚀.

All this time I’ve been holding liquidity📊 in the tsUSDe/USDe pool on the DEX In general, you can also use other ways to farm Ethena points, but the tsUSDe/USDe pool is the most profitable among them.

Also, besides the airdrop itself, you also get👇:

🔹0.37% APR from swap fees.

🔹12% APY (currently) from tsUSDe. It’s important to note that the pool ratio is 65%/35%, where 65% is $tsUSDe.

Also, there was recent news that by holding liquidity in the pool you’re also participating in the airdrop from TON Foundati

All this time I’ve been holding liquidity📊 in the tsUSDe/USDe pool on the DEX In general, you can also use other ways to farm Ethena points, but the tsUSDe/USDe pool is the most profitable among them.

Also, besides the airdrop itself, you also get👇:

🔹0.37% APR from swap fees.

🔹12% APY (currently) from tsUSDe. It’s important to note that the pool ratio is 65%/35%, where 65% is $tsUSDe.

Also, there was recent news that by holding liquidity in the pool you’re also participating in the airdrop from TON Foundati

- Reward

- like

- Comment

- Share

In almost a month of farming the Ethena airdrop, I’ve farmed 143k Ethena points🚀.

All this time I’ve been holding liquidity📊 in the tsUSDe/USDe pool on the DEX STONfi. In general, you can also use other ways to farm Ethena points, but the tsUSDe/USDe pool is the most profitable among them.

Also, besides the airdrop itself, you also get👇:🔹0.37% APR from swap fees.🔹12% APY (currently) from tsUSDe. It’s important to note that the pool ratio is 65%/35%, where 65% is tsUSDe.

Also, there was recent news that by holding liquidity in the pool you’re also participating in the airdrop from TON Foun

All this time I’ve been holding liquidity📊 in the tsUSDe/USDe pool on the DEX STONfi. In general, you can also use other ways to farm Ethena points, but the tsUSDe/USDe pool is the most profitable among them.

Also, besides the airdrop itself, you also get👇:🔹0.37% APR from swap fees.🔹12% APY (currently) from tsUSDe. It’s important to note that the pool ratio is 65%/35%, where 65% is tsUSDe.

Also, there was recent news that by holding liquidity in the pool you’re also participating in the airdrop from TON Foun

- Reward

- like

- Comment

- Share

- Reward

- like

- Comment

- Share

The DEX STONfi is expected to launch its DAO governance system very soon🚀. STON token stakers will be able to decide the future of the platform through voting📶.

This kind of mechanic isn’t very well known in the TON community yet, so here’s a quick breakdown of how it will most likely work🤔👇:

First of all☝️, to become part of the DAO, you’ll need to stake the STON token. Your voting power will depend on the amount of tokens you stake and the length of the lock-up🔒. This voting power is expressed as a percentage of the total amount of staked STON and can change as more tokens are staked or

This kind of mechanic isn’t very well known in the TON community yet, so here’s a quick breakdown of how it will most likely work🤔👇:

First of all☝️, to become part of the DAO, you’ll need to stake the STON token. Your voting power will depend on the amount of tokens you stake and the length of the lock-up🔒. This voting power is expressed as a percentage of the total amount of staked STON and can change as more tokens are staked or

- Reward

- like

- Comment

- Share

Which DEX has the best farming pools🤔?

STONfi – DeDust – TONCO

Let me clarify☝️: I’m comparing only the farming rewards, not the APR from regular liquidity provision.

DeDust has a good number of farming pools (Boosted pools), but in reality, only four of them stand out👇:

🔹HYDRA/TON – 35% APR

🔹AIC/USDT – 44% APR

🔹JETTON/TON and JETTON/USDT – 12% APR

The rest have under $50K TVL and APRs of just a few percent.

On TONCO, the situation is even worse — only two farming pools👇:🔹HYDRA/TON – 8% APR🔹bmTON/USDT – 4% APR

STONfi, on the other hand, clearly shows where the real liquidity on TON is.

STONfi – DeDust – TONCO

Let me clarify☝️: I’m comparing only the farming rewards, not the APR from regular liquidity provision.

DeDust has a good number of farming pools (Boosted pools), but in reality, only four of them stand out👇:

🔹HYDRA/TON – 35% APR

🔹AIC/USDT – 44% APR

🔹JETTON/TON and JETTON/USDT – 12% APR

The rest have under $50K TVL and APRs of just a few percent.

On TONCO, the situation is even worse — only two farming pools👇:🔹HYDRA/TON – 8% APR🔹bmTON/USDT – 4% APR

STONfi, on the other hand, clearly shows where the real liquidity on TON is.

- Reward

- like

- Comment

- Share

#OMNISTON is now integrated into the Telegram TON wallet🚀!

Now, when you swap🔄 tokens using the non-custodial Telegram TON wallet (formerly TON Space), the OMNISTON aggregator — which unites all liquidity on TON — will be used automatically🎯.

This means better exchange rates and maximum use of TON’s available liquidity📈.

In fact☝️, the SDK is currently the most integrated SDK on TON. Even before OMNISTON launched, was actively promoting it — and now, any service that previously integrated the SDK📌 can start using OMNISTON as well, simply by enabling the feature.

So when a service integ

Now, when you swap🔄 tokens using the non-custodial Telegram TON wallet (formerly TON Space), the OMNISTON aggregator — which unites all liquidity on TON — will be used automatically🎯.

This means better exchange rates and maximum use of TON’s available liquidity📈.

In fact☝️, the SDK is currently the most integrated SDK on TON. Even before OMNISTON launched, was actively promoting it — and now, any service that previously integrated the SDK📌 can start using OMNISTON as well, simply by enabling the feature.

So when a service integ

- Reward

- like

- Comment

- Share

Where is the most profitable place to store crypto?

Watch this video and find out!

#TON # Crypto #TON $TON # Telegram

Watch this video and find out!

#TON # Crypto #TON $TON # Telegram

TON5.44%

- Reward

- like

- Comment

- Share

Don’t buy Telegram gifts — we’re at the top or very close to it right now🧐.

Even if we imagine that the total market cap of gifts grows from the current $150M to $200M📈, it’s still not worth buying.

DON-2.14%

- Reward

- like

- Comment

- Share

If you’re experiencing high price impact📉 when swapping tokens on the DEX STONfi — Enable the OMNISTON feature🧐!

You can do this in the swap settings⚙️, where slippage is usually adjusted.

Once OMNISTON is enabled✅, you get access to all liquidity on TON without leaving STONfi. This can significantly reduce your losses when swapping tokens.

However☝️, if you’re choosing an unpopular token pair to swap, the price impact may not change. In that case, I recommend first swapping🔁 your tokens to TON, and then to the token you want.

By the way🤔, regarding OMNISTON — for now, it aggregates all li

You can do this in the swap settings⚙️, where slippage is usually adjusted.

Once OMNISTON is enabled✅, you get access to all liquidity on TON without leaving STONfi. This can significantly reduce your losses when swapping tokens.

However☝️, if you’re choosing an unpopular token pair to swap, the price impact may not change. In that case, I recommend first swapping🔁 your tokens to TON, and then to the token you want.

By the way🤔, regarding OMNISTON — for now, it aggregates all li

- Reward

- like

- Comment

- Share

What to do if the Price impact is high when swapping tokens on

If you’re experiencing high price impact📉 when swapping tokens on the DEX — Enable the OMNISTON feature🧐!

You can do this in the swap settings⚙️, where slippage is usually adjusted.

Once OMNISTON is enabled✅, you get access to all liquidity on TON without leaving . This can significantly reduce your losses when swapping tokens.

However☝️, if you’re choosing an unpopular token pair to swap, the price impact may not change. In that case, I recommend first swapping🔁 your tokens to TON, and then to the token you want.

By the way�

If you’re experiencing high price impact📉 when swapping tokens on the DEX — Enable the OMNISTON feature🧐!

You can do this in the swap settings⚙️, where slippage is usually adjusted.

Once OMNISTON is enabled✅, you get access to all liquidity on TON without leaving . This can significantly reduce your losses when swapping tokens.

However☝️, if you’re choosing an unpopular token pair to swap, the price impact may not change. In that case, I recommend first swapping🔁 your tokens to TON, and then to the token you want.

By the way�

- Reward

- like

- Comment

- Share